Services | Retirement Plan Fee Benchmarking

Background

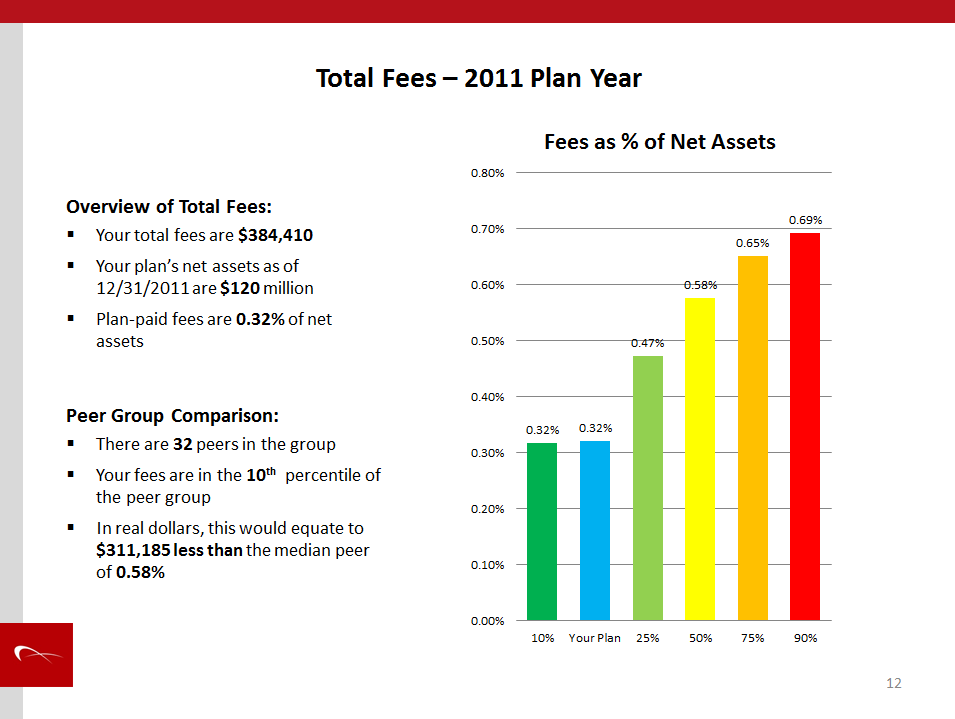

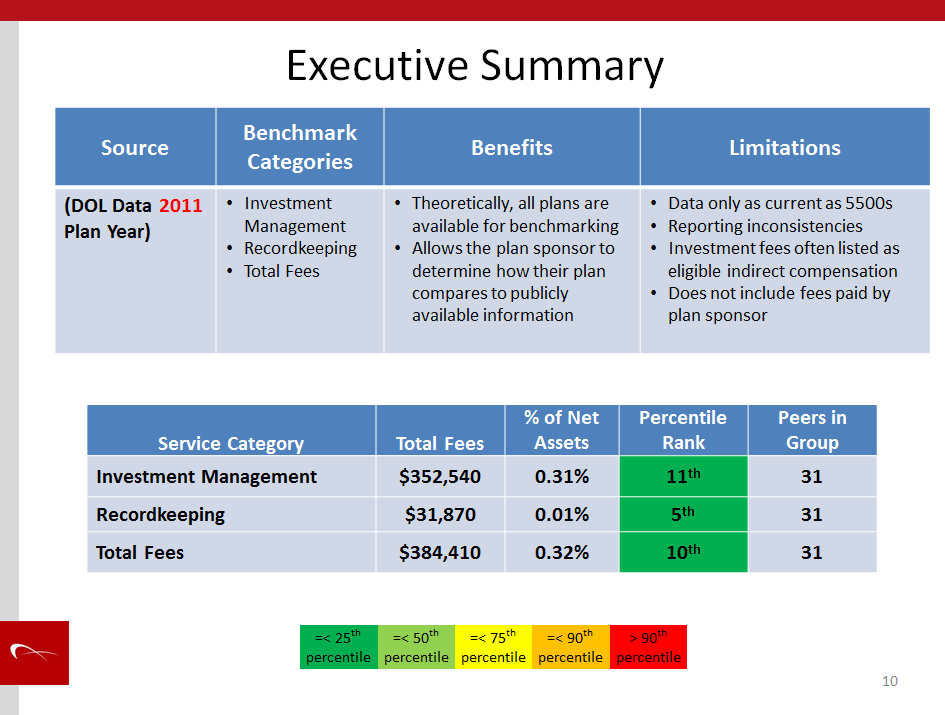

Department of Labor (DOL) regulations require greater transparency of fees in defined contribution and defined benefit plans. Comparing the plan’s fees against a large peer group of similar retirement plans is an effective means of determining fee reasonableness.

Why Is Fee Benchmarking Necessary?

- Reviewing the total value of each service provider is essential, but can be overwhelming for a Plan Sponsor.

- Fee benchmarking is a prudent and cost-effective method to aid the Plan Sponsor in meeting its fiduciary standard of conduct.

- Plan Sponsors should commission an independent firm to complete a fee benchmarking analysis of the plan’s service providers.

Benchmarking Expertise

Atéssa has successfully benchmarked both defined benefit and defined contribution plans for Fortune 10 companies. Atéssa’s in-depth analysis and customized benchmarking reports will provide the Plan Sponsor with the data and insight to make essential fiduciary decisions.

Please contact Mike Bourne at 858-673-3690 x109 or mbourne@atessabenefits.com to further discuss benchmarking your retirement plan. Atéssa will be happy to provide a complimentary “total plan fee” estimate based on your plan’s publicly available fee disclosures on Form 5500.